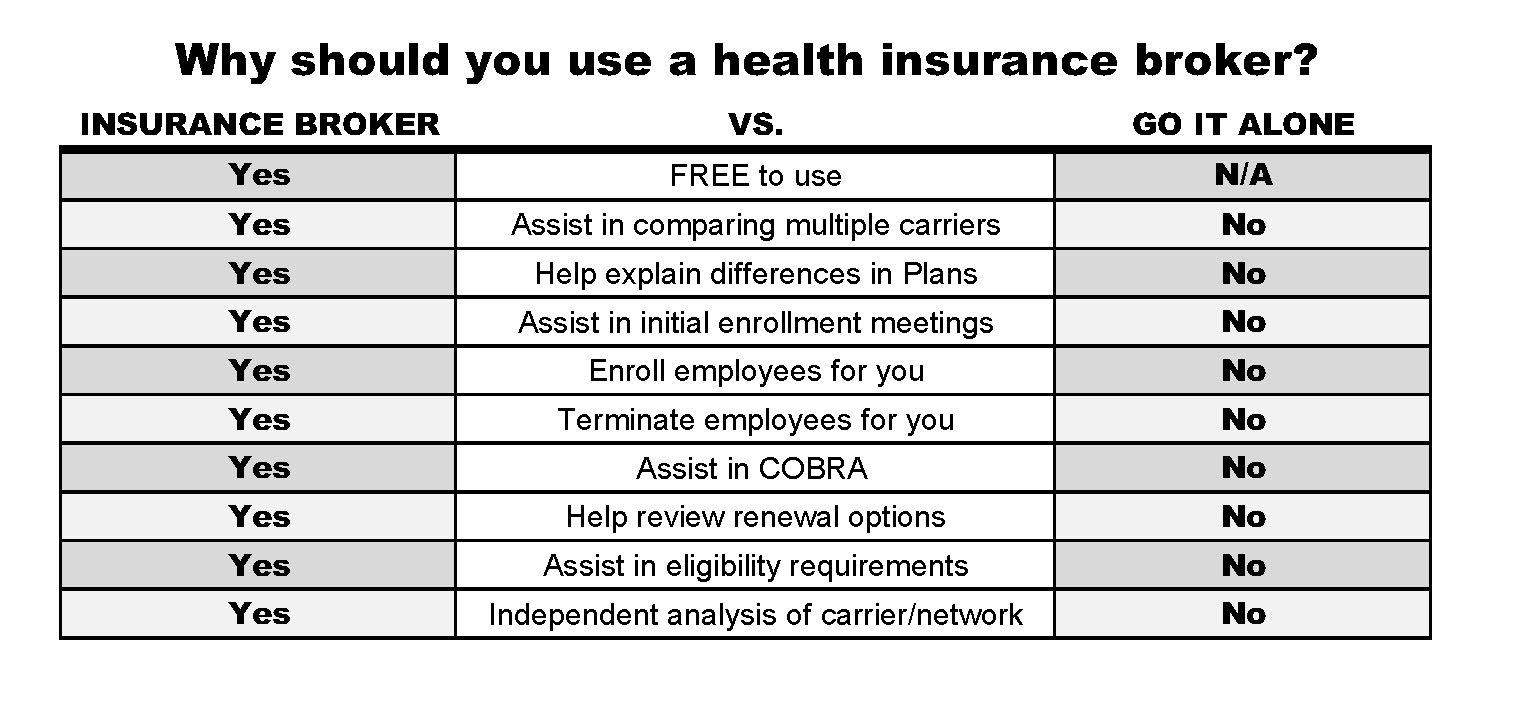

When shopping for health insurance, you might ask why should you use a health insurance broker. While you can certainly go it alone, the benefits of working with a professional health insurance broker are many.

You can use a broker’s services for free. Brokers make money through commissions that are already included in the cost of every health insurance plan, no matter where you buy it or whether a broker was involved. A health insurance plan never costs more because you use a broker. In fact, most states have filed rates that are fixed and non-negotiable, so if a broker can help advise you while you pay the same amount, you have nothing to lose and a lot to gain by using a broker.

An independent broker can help you compare plans and companies, help devise a strategy for covering different classes of employees, and advise on each carrier’s specific enrollment requirements to make sure you qualify for coverage. They will work with you throughout the year to maintain the policy in terms of assisting with new enrollments and terminations. They also help explain plan benefits to new and existing employees.

At renewal time, they will assist in reviewing the new plan rates and any benefit changes, and can review alternative carrier plans when/if rates change. They also assist when you get an audit or need to verify compliance which can be overwhelming for a business.

Some things to consider when looking for a broker:

– Do they have any professional credentials in this field? Commitment in the field shows knowledge and experience.

– How long have they been in the business for? With time comes experience, and the more the broker has the better.

– Do they have happy customers? Testimonials are a good way to judge approval of a broker’s work.

Health Insurance Brokers are a no lose decision. Health insurance rates are non-negotiable for small groups, so having a trusted advisor in your corner that can assist in the day to day administration of your plan, help compare carriers and benefit options, and assist in enrolling new employees onto your plan all for no cost should certainly answer the question: Why should you use a health insurance broker!

James Eckardt, RHU is the President of Peak Advisors Inc. in Holtsville NY, and the opinions above are his own. You should review your broker carefully and request references as needed.